ZIP Turkey

Zip Turkey offers fast credit opportunities with our BNPL (Buy Now, Pay Later) solution for both online and offline purchases. Customers can use credit limits exceeding their purchase amount for future shopping. Our credits are available with or without interest. Through our mobile and web applications, we enhance customer experiences and streamline transactions.

We have successfully executed the project encompassing:

- Innovative Application Design & Development

- Seamless UX/UI Design & Implementation

- Streamlined Digital New Customer Onboarding

- Customized Whitelabelling Solutions

We revolutionize credit solutions with our BNPL (Buy Now, Pay Later) product, offering fast and convenient credit opportunities for both online and offline purchases. Our customers can enjoy financing options during shopping, either in-store (offline channel) or remotely (online channel).

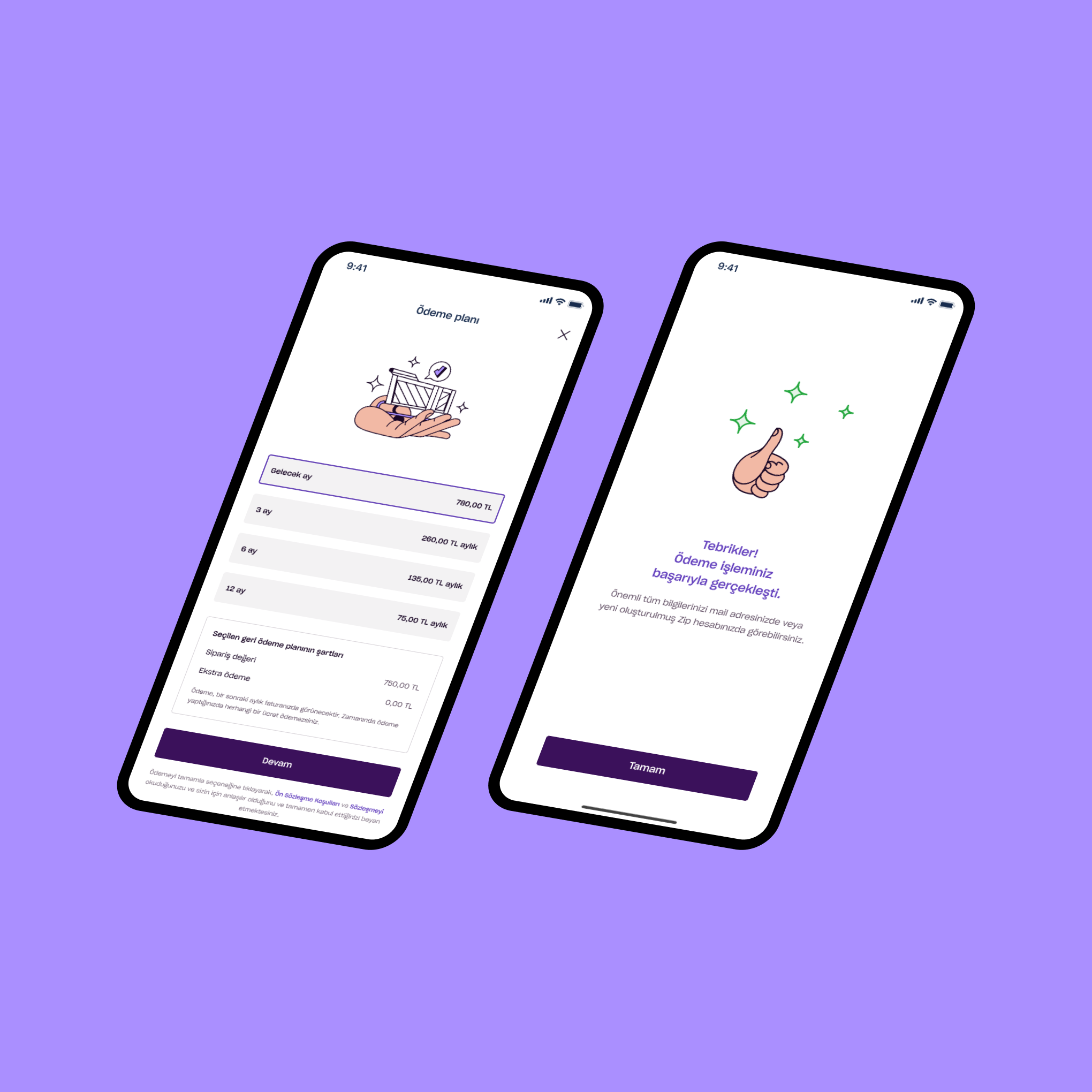

The “buy now, pay later” credit is tailored to each customer based on risk rules set by the financing institution. Upon approval, customers receive a credit limit that may even exceed their purchase amount, allowing them to utilize the remaining credit for future purchases. Each purchase triggers an up-to-date limit inquiry to ensure seamless transactions.

Our credit options can be interest-free or with interest, depending on the preference of the integrating lender. We provide flexibility through our campaign module, where parametric adjustments can be made. Backoffice screens allow easy administrative access to manage settings through the campaign module.

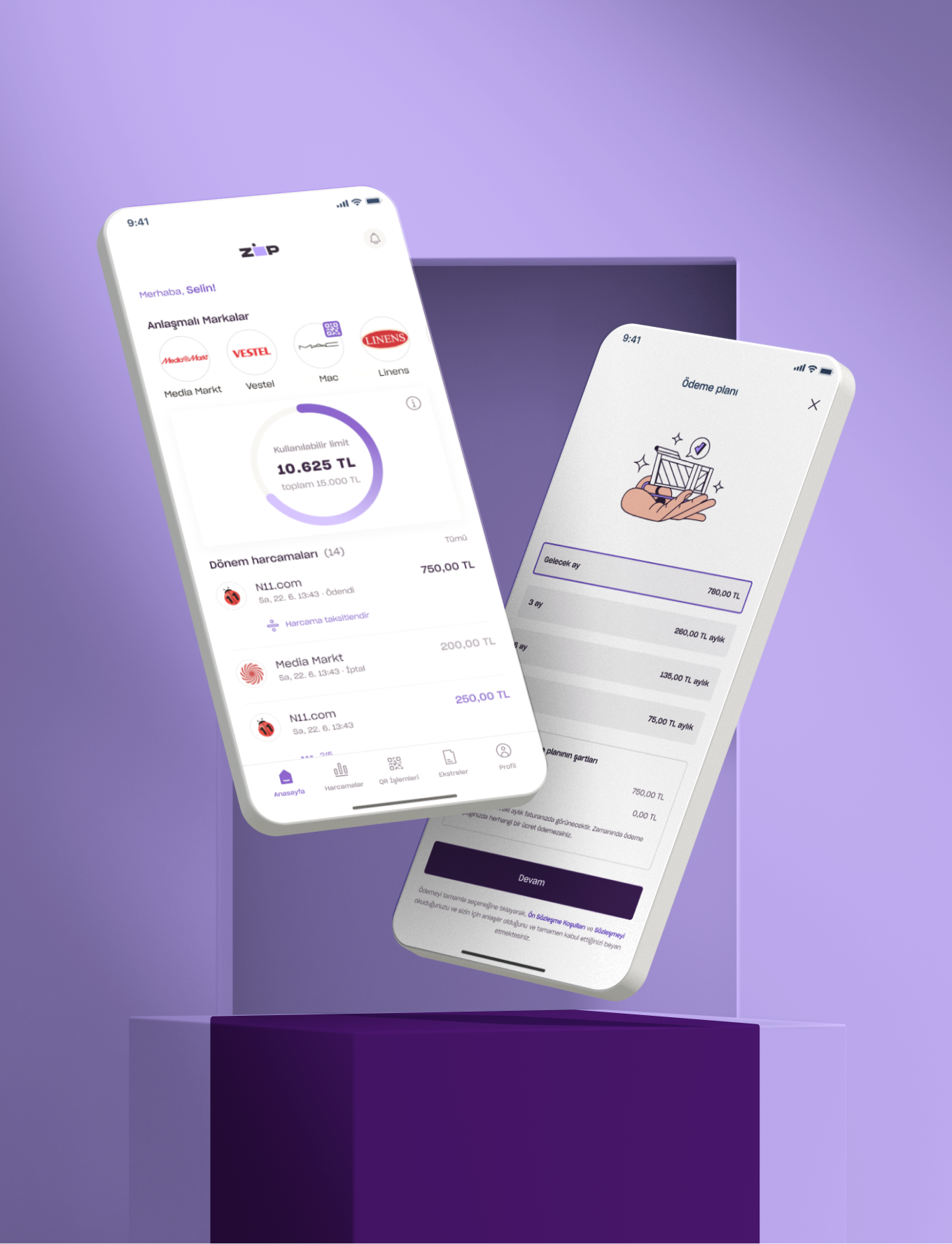

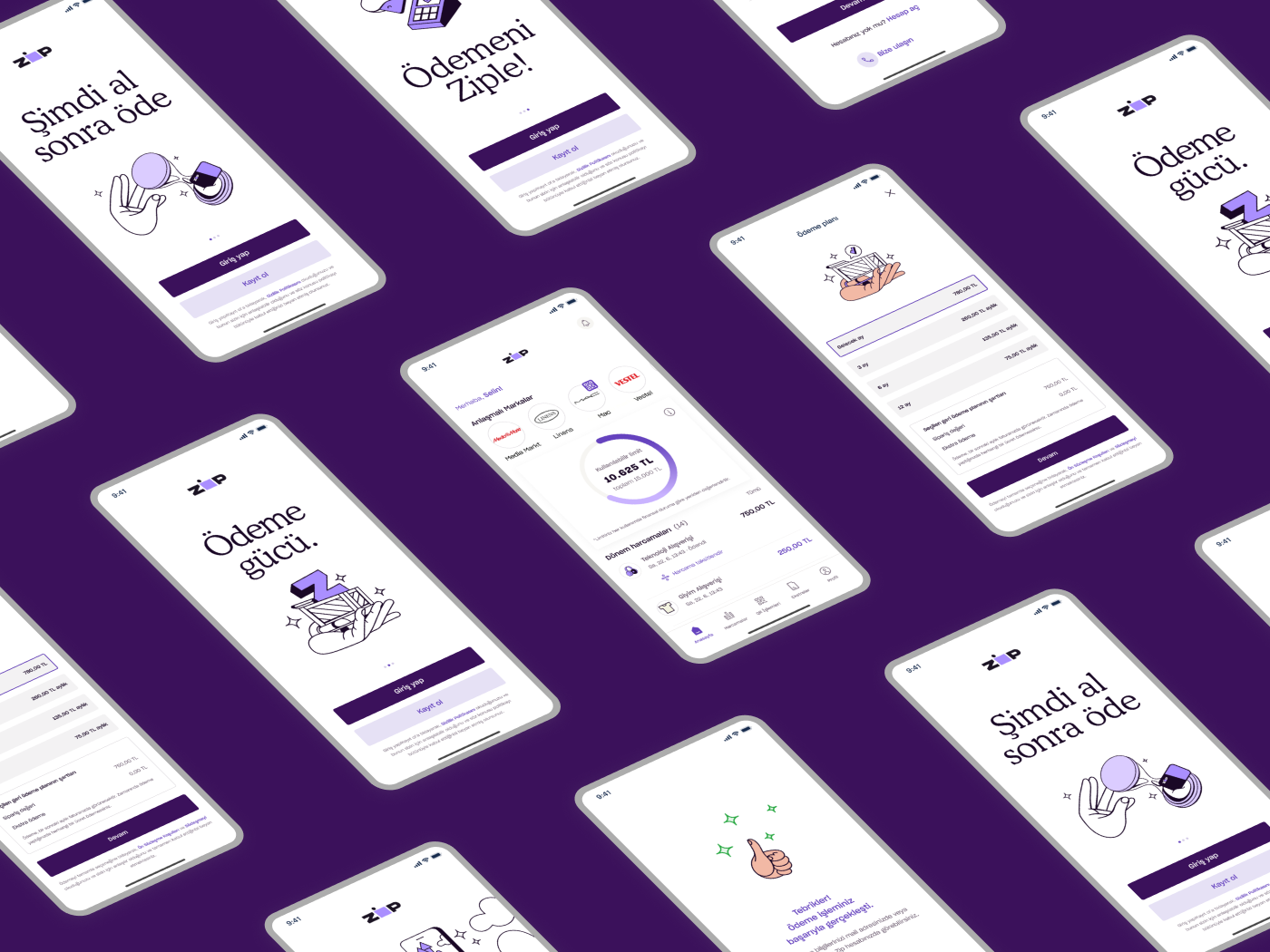

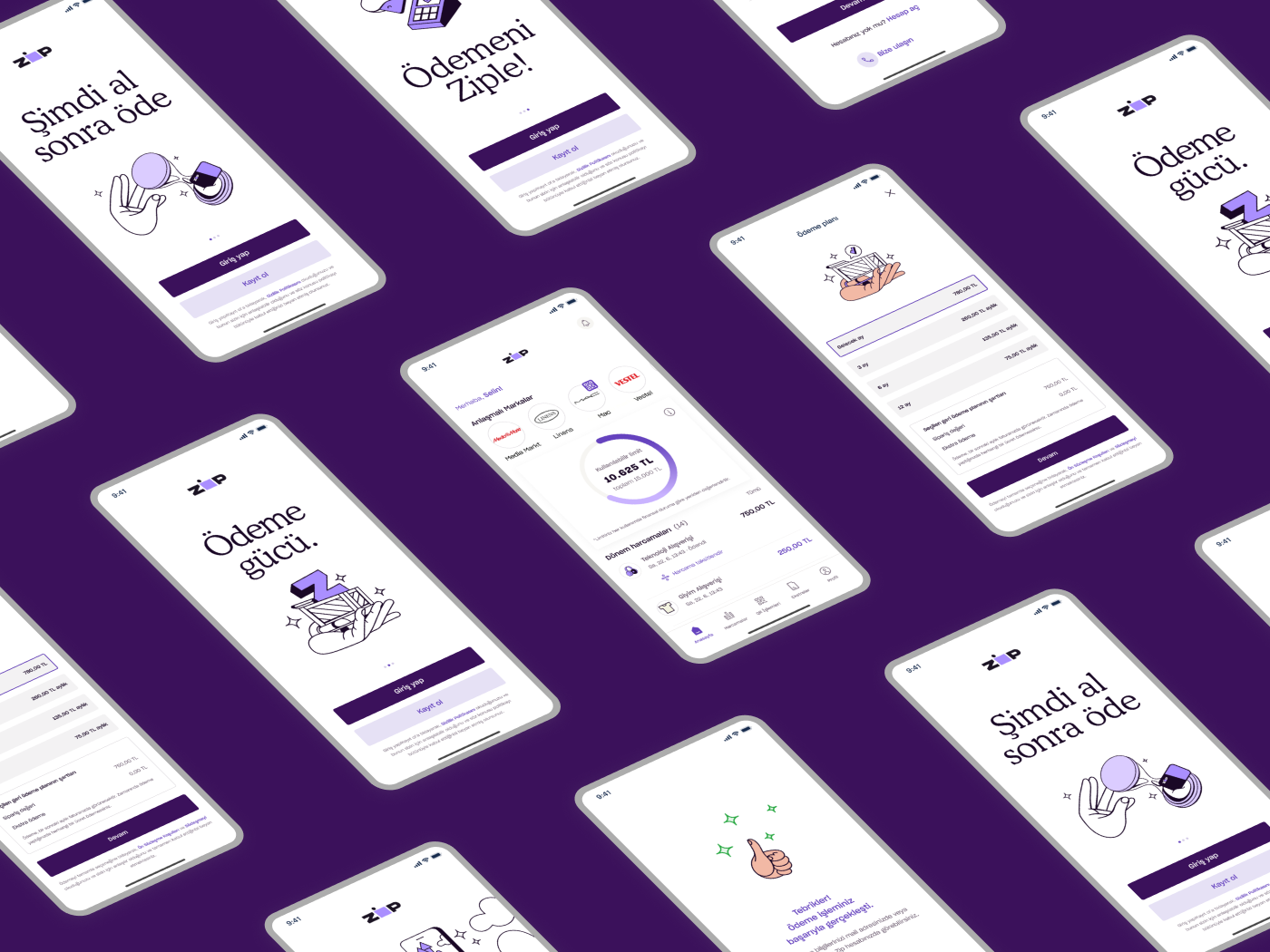

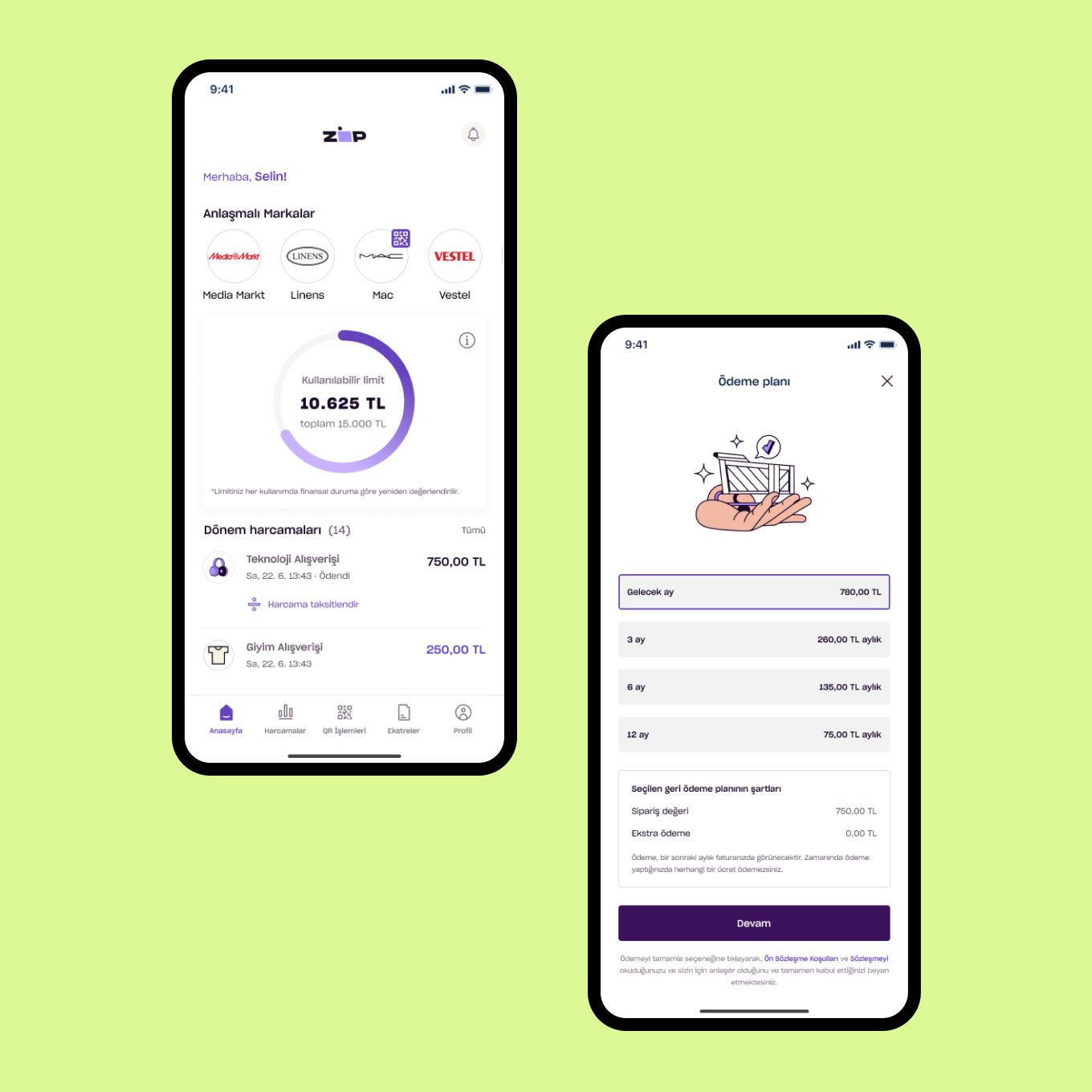

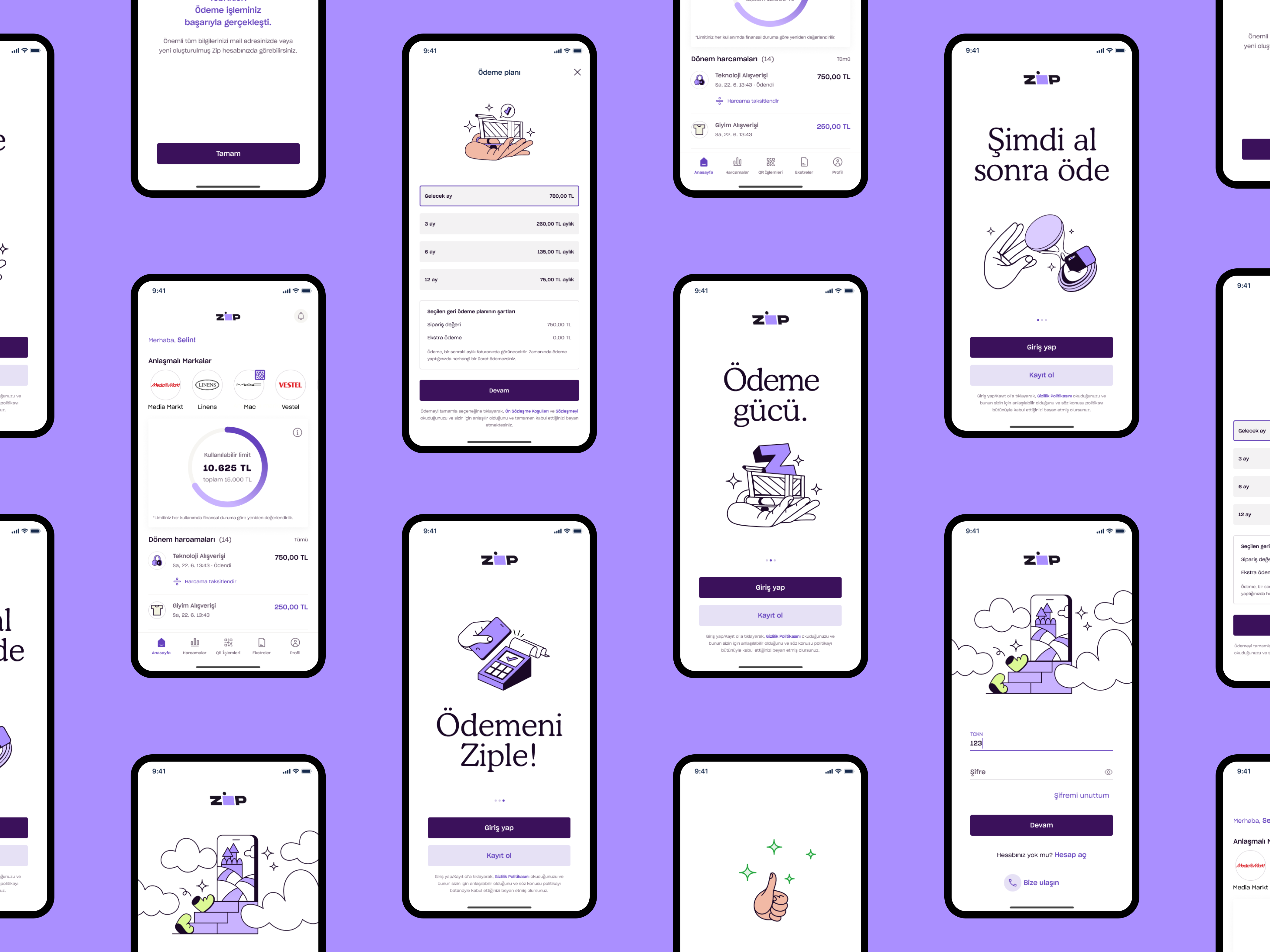

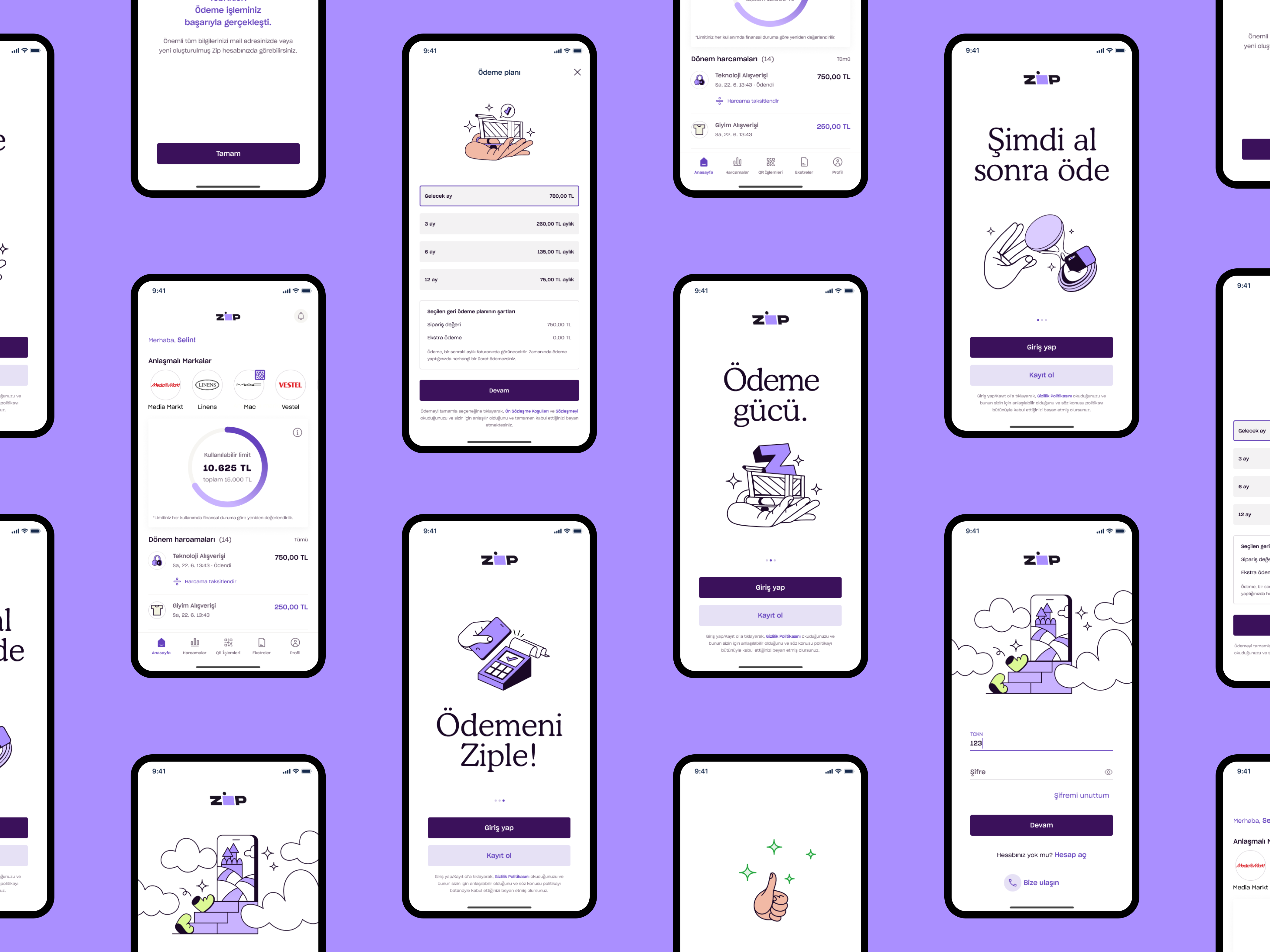

For the convenience of end-users, we developed a user-friendly mobile application, featuring a simple, elegant, and trendy UX/UI design. The Native iOS and Android app is also compatible with Huawei phones, offering a seamless experience.

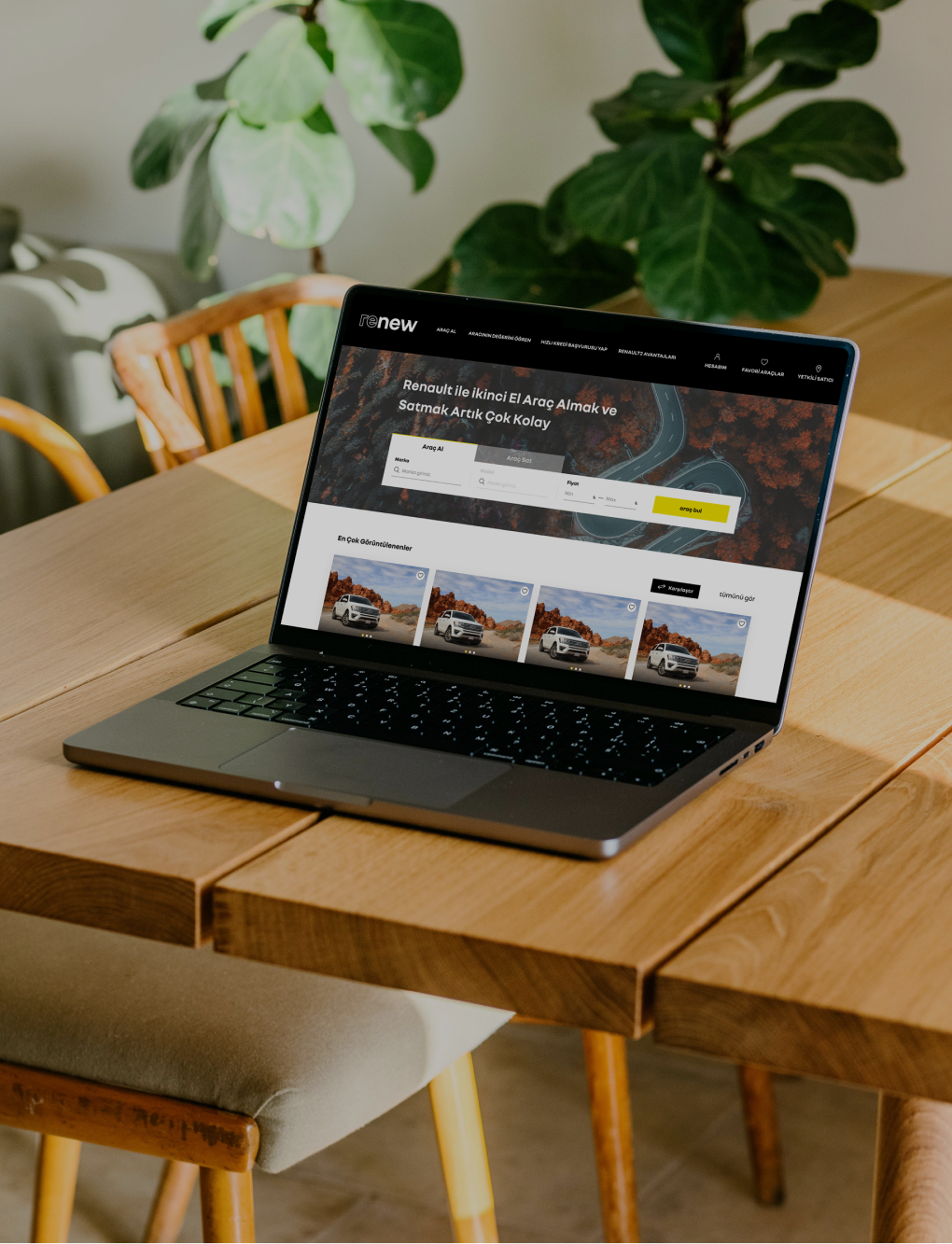

Additionally, our web application includes a Dealer panel and admin screens designed for corporate customers and store employees. With a focus on UX, we prioritized simplicity and functionality, ensuring that any transaction can be completed swiftly.

At Innovance, we are dedicated to providing cutting-edge credit solutions that enhance customer experiences and streamline processes.

Offline Channels

Customers in offline stores have two convenient options for BNPL transactions. They can either use BNPL directly through a QR code on the point-of-sale (POS) system or initiate the process through the online panel by logging in and adding items to their shopping basket. Afterward, the customer downloads our mobile application and approves the credit request. Let’s delve into each option:

Dealer Panel Option:

Our web application offers merchants various functions, including credit sales, pre-approved limit inquiries, and credit monitoring. These functions enable seamless credit sales with product information input and flexible options for existing and new customers. The process concludes smoothly within the customer’s mobile application. Additionally, the Dealer Panel provides a quick pre-approved limit inquiry for both the customer and store user. Authorized store users can monitor ongoing or cancelled credit processes and even calculate payment plan examples for customers.

Payment Option:

With the Payment Option, the customer starts the payment process by scanning the QR code generated on the in-store POS device, indicating their presence in the store. The process then directly proceeds within the mobile application, without requiring initiation from the merchant’s web-based dealer panel application. Both credit sales and credit cancellation processes are carried out very quickly using QR codes, ensuring a fast and convenient experience.

Both credit sales and credit cancellation processes are carried out very quickly using QR codes.

Online Channels

We provide two distinct options for customers seeking credit on online channels. For those who prefer to continue the sales process on their own web screens, we offer credit sales services as APIs. Additionally, for merchants who do not wish to develop screen integration, we provide a seamless redirection to our web screens for credit offerings.

API Process:

This process includes essential services like limit inquiry, payment plan listing, and contract approval, tailored for customers conducting e-commerce using our secure infrastructure.

Web Screen Integration:

For integrated e-commerce customers (merchants), we share a link to access the web screens. The credit sales flow is completed within these screens, with customers then redirected back to their own interface.

For both processes, integration is made swift and hassle-free after setting up new customer (merchant) definitions through admin screens.

Fast and Convenient Customer Acquisition

This solution ensures swift customer acquisition in both our online and in-store options. For in-store acquisitions, end users can upload signed customer documents through the dealer panel website.

In the online option, customers can easily register without visiting the store by scanning their ID card using mobile NFC technology. For higher limit purchases, customer acquisition can be achieved through video call conversations.

Our user-friendly admin screens enable parametric management of various flows for lending lenders. Key functions include campaign observation and definition (interest-bearing, interest-free, and different terms), e-shop definitions and monitoring, credit cancellation/refund, customer information observation, decision support system result monitoring, third-party integration logs observation, manual installment matching (users can match EFT payments with installments), and credit card payment tracking.

With our web and mobile application solutions, both end-users and corporate customers, as well as store employees, can easily utilize BNPL services.

0

Months

MVP was developed and launched within just 3 months.

0

Active users in 9 months

Within 9 months, it garnered an impressive user base of 64,183 active users.

0

TL (71.258 cases) in 9 months

Within 9 months, a total credit issuance of 945.045.840,6 TL (71.258 cases) was achieved, it solidified its position as Turkey’s fastest-growing BNPL start-up.

WE ARE READY TO HELP YOUR BUSINESS

Interested to enquire about our capabilities and how we can cooperate?

We are very much interested about your current technology challenges and your upcoming business requirements; our experts will be happy to schedule a call and discuss possibilities together.